Understanding the Features and Capabilities of GoldSilverStacker

Are you interested in investing in precious metals like gold? If so, it's important to understand the various terms and features associated with bullion trading. Our website aims to provide you with a comprehensive understanding of these concepts, empowering you to make informed decisions. Let's explore some of the key features and capabilities of our website to help you navigate the world of bullion trading.

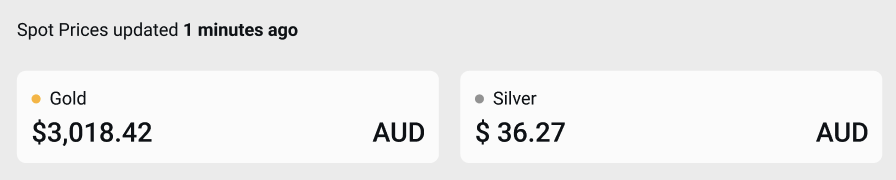

Spot Price: The Global Value of Gold

One of the fundamental concepts in bullion trading is the spot price, which represents the globally recognized value of gold. Bullion dealers around the world utilize this price as a benchmark to determine the value of their precious metals. The spot price is subject to fluctuations due to factors such as supply and demand dynamics and the overall state of the economy. By keeping track of the spot price, you can stay updated on the current value of gold.

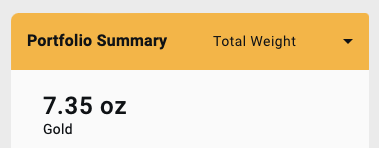

Oz - Troy Ounces: A Universal Measurement!

When it comes to measuring the weight of bullion products, troy ounces serve as a universal standard. Troy ounces are commonly used and recognized globally in the bullion industry. Whether you purchase bullion products from major mints worldwide, they are likely to be sold in troy ounces, often abbreviated as "Troy Oz." It's important to note that one troy ounce is equivalent to 31.1 grams, providing a consistent measurement reference for bullion weights.

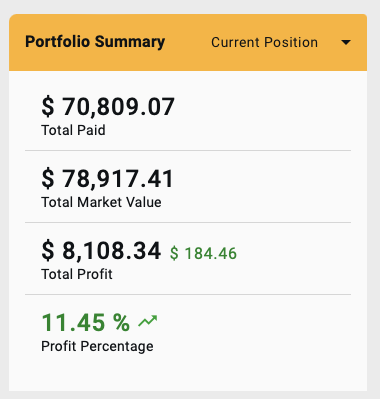

Market Value per Oz: Assessing the Value of Your Bullion

Market value per ounce refers to the market value of a specific bullion product per troy ounce. To calculate this, we divide the total market value of the product by its troy ounce quantity. Understanding the market value per ounce is crucial, as it allows you to gauge the potential selling price for each coin if you decide to liquidate your investment. This information provides valuable insights into potential profits or losses.

Paid pricer per OZ and Premium

The paid price per ounce and premium are essential factors to consider when assessing your investment. The paid price per ounce is the amount you initially paid for your bullion, divided by its troy ounce quantity. Comparing the paid price per ounce with the market value per ounce enables you to calculate your profit or loss accurately.

The premium, while a bit more complex, represents the additional amount above the spot price that your coin is worth. For instance, if the spot price for gold is $3,000 per ounce and the market value for a standard coin is $3,150, the premium would be $150. Monitoring the premium helps you understand the added value your coin holds beyond the spot price.

Market Value: Determining the Sale Price

Market value refers to the price at which a retailer would sell a specific bullion product. It is calculated by adding a premium to the live spot price. The market value is influenced by fluctuations in the live spot price, meaning that as the spot price of gold increases, the market value of your precious metals also tends to rise. By tracking the market value, you can stay informed about the current value of your bullion based on your initial purchase price. This information is particularly useful for calculating potential profits.

Economic Loss: Evaluating Selling Options

The economic loss feature is a tool that helps you determine the potential loss if you were to sell your bullion at the spot price. It calculates the market value of a coin, including any paper gains (unrealized profits), and subtracts that from the spot price. This provides an estimate of the potential profit missed out on. If the economic loss is not aligned with your financial goals, selling your bullion on the free market might be a more suitable option.

Our website aims to equip users with a comprehensive understanding of the features and capabilities of bullion trading. By familiarizing yourself with concepts such as the spot price, troy ounces, market value per ounce, paid price per ounce, premium, and market value, you can make informed decisions about your bullion investments. Whether you're a seasoned investor or new to the world of precious metals, our website provides the tools and information you need to navigate the complex and fascinating realm of bullion trading.

Disclaimer: This article is intended as an opinion piece and does not constitute financial advice. Investing in bullion carries risks, and individuals should conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Links for places to start investing now:

- https://bullionnow.com.au

- https://www.ainsliebullion.com.au

- https://www.abcbullion.com.au

- https://guardian-gold.com.au

Try our bullion tracker today and see the benefits for yourself!

Our bullion tracker is the easiest way to track the value of your precious metals holdings. It's fast, easy to use, and affordable.

Here are just a few of the benefits of using our bullion tracker:

- Stay organized: Keep track of all of your precious metals holdings in one place.

- Make informed decisions: Know the current value of your holdings so you can make better decisions about when to buy and sell.

- Save money: Avoid overpaying for precious metals by knowing the current market value.

Plus, we offer a free 30-day trial so you can try our bullion tracker risk-free.

Sign up today and start tracking the value of your precious metals holdings!

Start your free trial now: https://goldsilverstacker.com