How to Choose Between Different Types of Bullion Coins and Bars: A Guide for SMSF Investors

In the previous articles, we explained how you can invest in bullion using your self managed super fund (SMSF) in Australia, how you can track your bullion investments using GoldSilverStacker, the best tool for SMSF investors, and how you can understand some of the key terms and features that are used in portfolio tracking. In this article, we will introduce you to some of the different types of bullion coins and bars that are available in the market, and what are the advantages and disadvantages of each type.

Bullion coins and bars are physical forms of precious metals, such as gold, silver, platinum and palladium. They are usually minted or cast by reputable refiners or mints, and have a high purity and weight. Bullion coins and bars are popular among investors who want to diversify their portfolio, hedge against inflation and currency devaluation, and protect their wealth from economic and political uncertainties.

However, not all bullion coins and bars are the same. There are different types of bullion coins and bars that vary in design, quality, price, premium, liquidity and collectability. Here are some of the most common types of bullion coins and bars that you can choose from:

Bullion Coins:

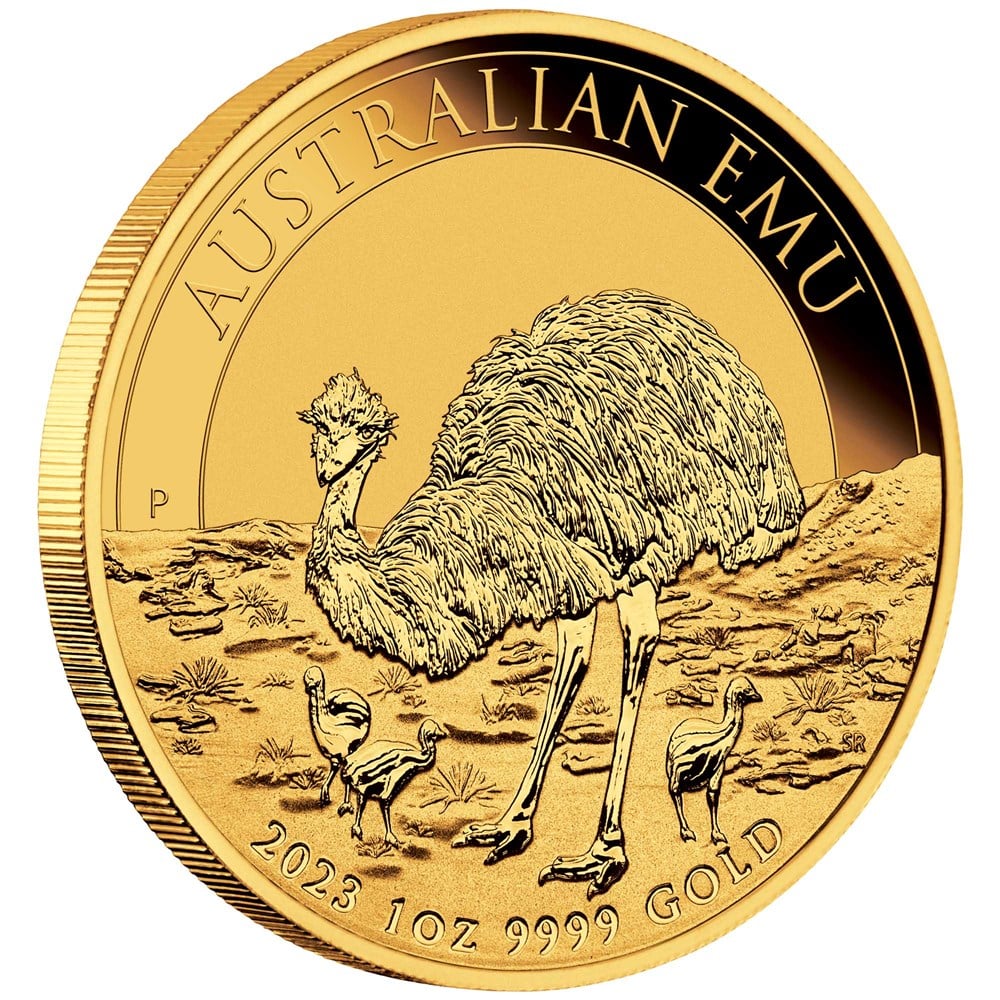

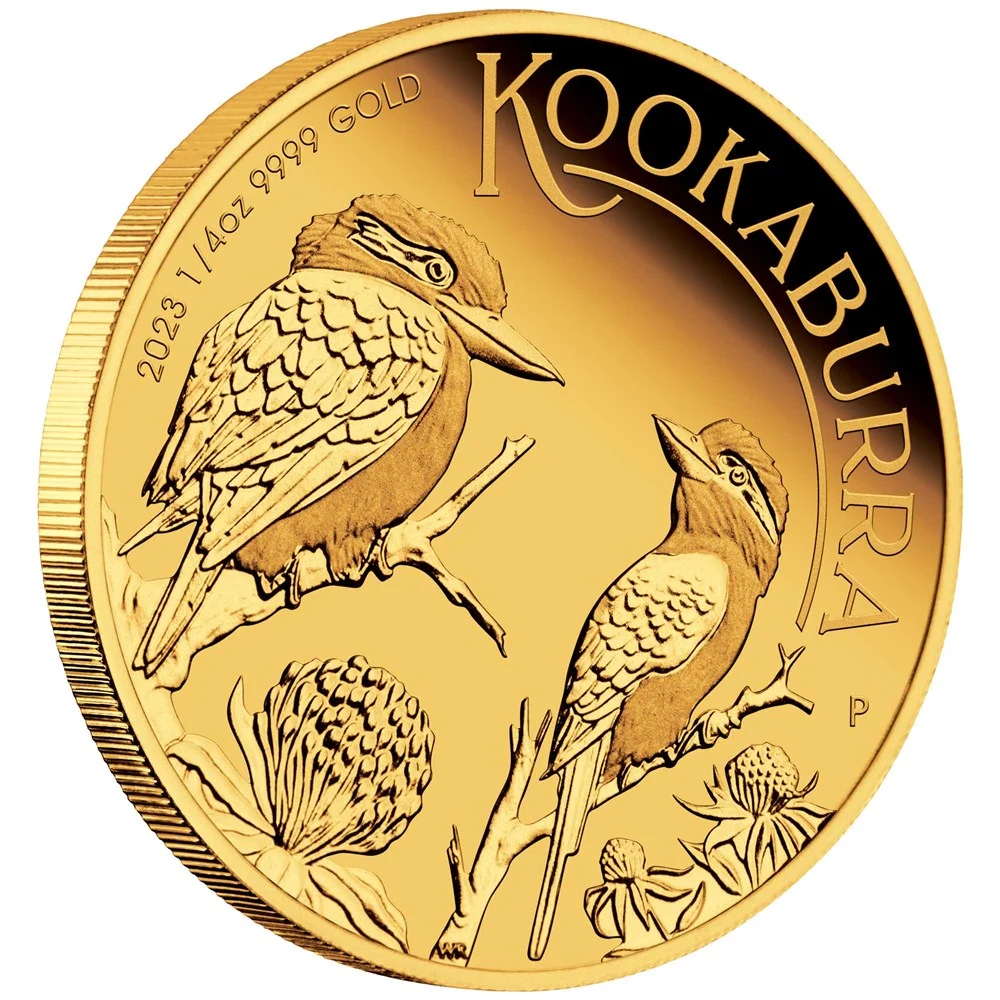

Bullion coins are legal tender coins that have a face value and a metal content. They are usually minted by government mints or authorized private mints, and have a standard weight and purity. Bullion coins often feature iconic designs that reflect the culture, history or wildlife of the issuing country.

Some of the advantages of bullion coins are:

- They are easy to buy, sell and store.

- They have a high liquidity and demand in the market.

- They have a low premium over the spot price of the metal.

- They have a legal tender status that guarantees their weight and purity.

Some of the disadvantages of bullion coins are:

- They may have a higher price than bullion bars due to their minting costs.

- They may have a lower purity than bullion bars due to their alloy content.

- They may have a limited supply or availability due to their annual production.

Some examples of popular bullion coins are:

- American Eagle

- Canadian Maple Leaf

- Australian Kangaroo

- Chinese Panda

Proof Coins:

Proof coins are special edition coins that have a higher quality and finish than bullion coins. They are usually minted by government mints or authorized private mints, and have a limited mintage and a certificate of authenticity. Proof coins often feature intricate designs that showcase the craftsmanship and technology of the mint.

Some of the advantages of proof coins are:

- They have a higher aesthetic appeal and collectability than bullion coins.

- They have a higher rarity and value than bullion coins due to their limited production.

- They have a higher potential for appreciation than bullion coins due to their numismatic value.

Some of the disadvantages of proof coins are:

- They have a higher premium over the spot price of the metal than bullion coins due to their production costs.

- They have a lower liquidity and demand in the market than bullion coins due to their niche appeal.

- They require more care and protection than bullion coins due to their delicate finish.

Some examples of popular proof coins are:

- American Eagle Proof

- Canadian Maple Leaf Proof

- Australian Lunar Proof

- Chinese Panda Proof

High Relief Proof Coins:

High relief proof coins are special edition coins that have a higher relief and depth than proof coins. They are usually minted by government mints or authorised private mints, and have a very limited mintage and a certificate of authenticity. High relief proof coins often feature stunning designs that create a 3D effect on the coin.

Some of the advantages of high relief proof coins are:

- They have an exceptional aesthetic appeal and collectability than proof coins.

- They have an extreme rarity and value than proof coins due to their very limited production.

- They have an extraordinary potential for appreciation than proof coins due to their numismatic value.

Some of the disadvantages of high relief proof coins are:

- They have an exorbitant premium over the spot price of the metal than proof coins due to their production costs.

- They have a very low liquidity and demand in the market than proof coins due to their niche appeal.

- They require the utmost care and protection than proof coins due to their delicate finish.

Some examples of popular high relief proof coins are:

- American Liberty High Relief

- Canadian Maple Leaf High Relief

- Australian Kangaroo High Relief

- Chinese Panda High Relief

Bullion Bars:

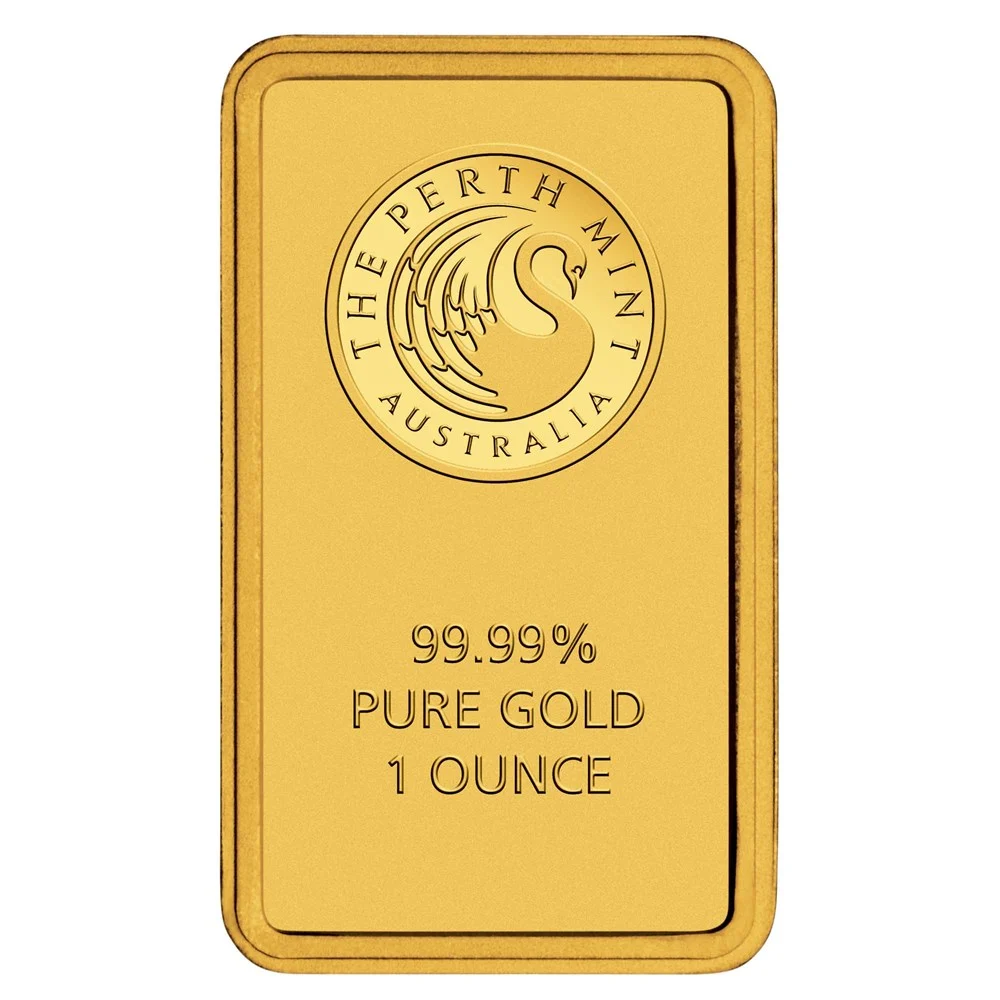

Bullion bars are rectangular or square pieces of metal that have a weight and a purity. They are usually cast or minted by reputable refiners or mints, and have a simple design that features the logo, name, weight and purity of the producer.

Some of the advantages of bullion bars are:

- They have a lower price than bullion coins due to their lower production costs.

- They have a higher purity than bullion coins due to their lower alloy content.

- They have a higher weight than bullion coins due to their larger size.

Some of the disadvantages of bullion bars are:

- They have a lower liquidity and demand in the market than bullion coins due to their lower recognition.

- They have a higher premium over the spot price of the metal than bullion coins due to their higher weight.

- They require more space and security than bullion coins due to their larger size.

Some examples of popular bullion bars are:

- PAMP Suisse

- Perth Mint

- Royal Canadian Mint

- Scottsdale Mint

Minted Bars:

Minted bars are special edition bars that have a higher quality and finish than bullion bars. They are usually minted by reputable refiners or mints, and have a limited mintage and a certificate of authenticity. Minted bars often feature elaborate designs that reflect the theme, style or brand of the producer.

Some of the advantages of minted bars are:

- They have a higher aesthetic appeal and collectability than bullion bars.

- They have a higher rarity and value than bullion bars due to their limited production.

- They have a higher potential for appreciation than bullion bars due to their numismatic value.

Some of the disadvantages of minted bars are:

- They have a higher premium over the spot price of the metal than bullion bars due to their production costs.

- They have a lower liquidity and demand in the market than bullion bars due to their niche appeal.

- They require more care and protection than bullion bars due to their delicate finish.

Some examples of popular minted bars are:

- PAMP Suisse Lunar Series

- Perth Mint Dragon Series

- Royal Canadian Mint MapleGram Series

- Scottsdale Mint Stacker Series

These are some of the different types of bullion coins and bars that you can choose from when investing in precious metals using your SMSF. Each type has its own advantages and disadvantages, depending on your preferences, goals and circumstances. You should consider factors such as price, premium, purity, weight, liquidity, demand, collectability, design, quality and storage when choosing between different types of bullion coins and bars.

To help you track your precious metal portfolio, you can use GoldSilverStacker, the best tool for SMSF investors. GoldSilverStacker is a user-friendly and comprehensive platform that allows you to track the real-time value of your precious metals stack, gain investment insights, and manage your portfolio with ease. GoldSilverStacker supports all types of bullion coins and bars, as well as pool-allocated products. GoldSilverStacker also offers features such as live spot price tracking, portfolio summary breakdown, total market value, total paid price, total profit, total profit percentage, total weight, average prices per metal, economic loss, premium paid, real-time market value updates, graphs and trend analysis, and account synchronisation.

GoldSilverStacker is the best tool for tracking your precious metal portfolio using your SMSF. It offers a user-friendly and comprehensive platform that outperforms the Bullion Spreadsheet Tracker in every aspect, making it a superior alternative for SMSF investors.

If you want to try out GoldSilverStacker and experience its benefits first-hand, you can sign up for a free trial today and start tracking your bullion in under 15 seconds.

Disclaimer: This article is intended as an opinion piece and does not constitute financial advice. Investing in bullion carries risks, and individuals should conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Links for places to start investing now:

- https://bullionnow.com.au

- https://www.ainsliebullion.com.au

- https://www.abcbullion.com.au

- https://guardian-gold.com.au

Try our bullion tracker today and see the benefits for yourself!

Our bullion tracker is the easiest way to track the value of your precious metals holdings. It's fast, easy to use, and affordable.

Here are just a few of the benefits of using our bullion tracker:

- Stay organised: Keep track of all of your precious metals holdings in one place.

- Make informed decisions: Know the current value of your holdings so you can make better decisions about when to buy and sell.

- Save money: Avoid overpaying for precious metals by knowing the current market value.

Plus, we offer a free 30-day trial so you can try our bullion tracker risk-free.

Sign up today and start tracking the value of your precious metals holdings!

Start your free trial now: https://goldsilverstacker.com