How Gold and Silver are a Safe Bet for Investing During a Recession or Depression

The global economy is facing unprecedented challenges due to the COVID-19 pandemic, which has triggered a deep recession and possibly a depression in some countries. Many investors are looking for ways to protect their wealth and hedge against inflation, currency devaluation, and market volatility. One of the most popular and effective ways to do so is to invest in gold and silver, two precious metals that have a long history of being safe-haven assets during times of crisis.

But how do gold and silver perform during a recession or a depression? What are the factors that influence their prices and demand? And how can investors take advantage of their potential benefits? In this article, we will explore these questions and provide some insights and tips for investing in gold and silver during a recession or a depression.

Gold and Silver Performance During Past Recessions and Depressions

Gold and silver have different characteristics and drivers that affect their performance during economic downturns. Gold is mainly driven by investment demand, while silver is also influenced by industrial demand. Gold is more scarce and expensive than silver, while silver is more volatile and speculative than gold. Therefore, gold and silver may not always move in the same direction or at the same pace during a recession or a depression.

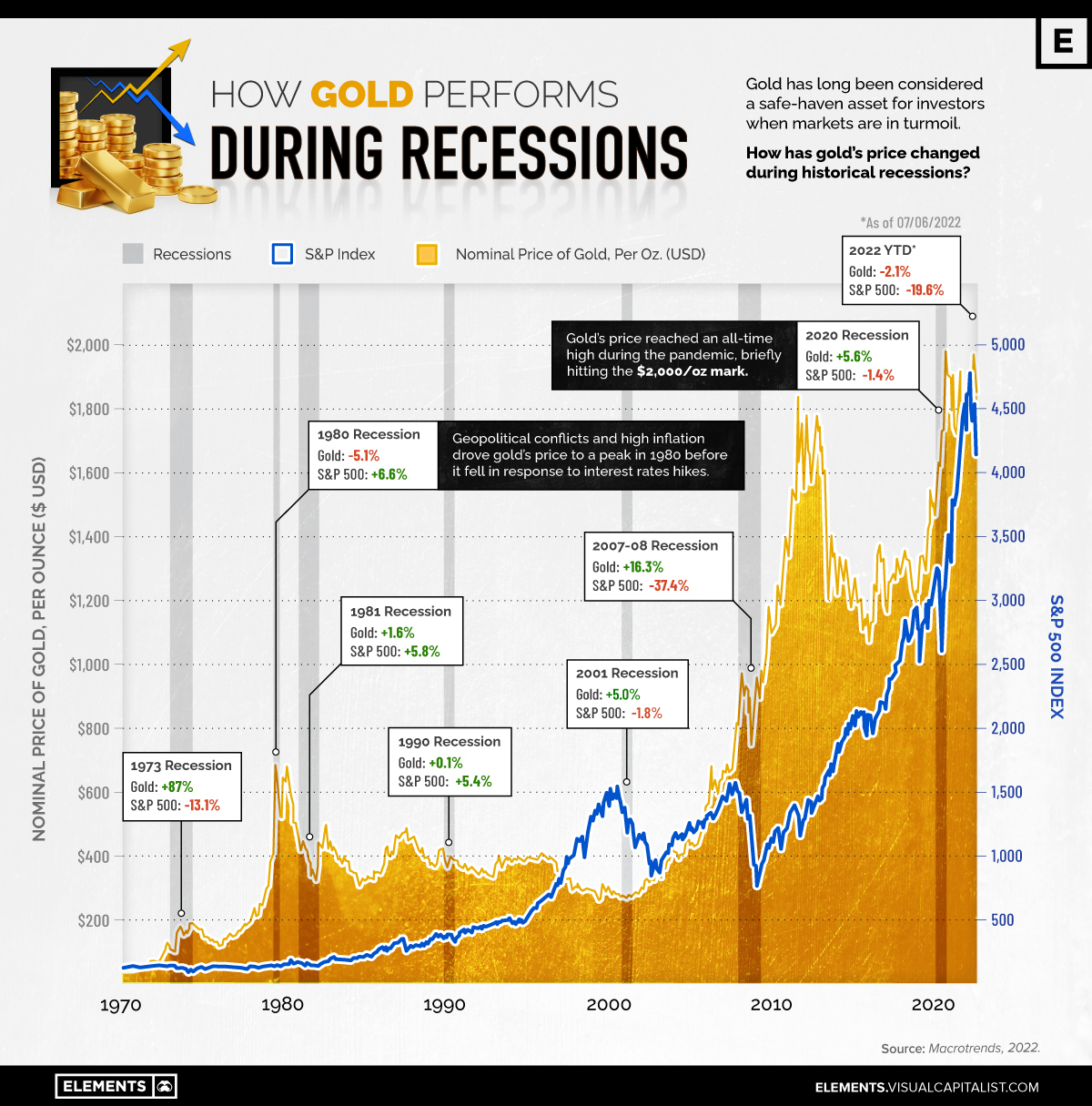

To illustrate this point, let’s look at how gold and silver performed during some of the past recessions and depressions since 1970:

1973-1975 Recession: This recession was caused by the oil crisis, which led to high inflation and stagflation. Gold rose by 134% from $65.10 per ounce in January 1973 to $152.50 per ounce in March 1975. Silver rose by 75% from $2.06 per ounce to $3.60 per ounce in the same period12

1980-1982 Recession: This recession was caused by the Federal Reserve’s tight monetary policy, which aimed to curb inflation and stabilise the dollar. Gold fell by 46% from $850 per ounce in January 1980 to $456 per ounce in November 1982. Silver fell by 64% from $49.45 per ounce to $17.75 per ounce in the same period12

1990-1991 Recession: This recession was caused by the savings and loan crisis, the Gulf War, and the collapse of the Soviet Union. Gold fell by 6% from $416 per ounce in July 1990 to $391 per ounce in March 1991. Silver fell by 12% from $5.25 per ounce to $4.62 per ounce in the same period12

2001 Recession: This recession was caused by the dot-com bubble burst, the September 11 attacks, and the accounting scandals. Gold rose by 8% from $271 per ounce in March 2001 to $293 per ounce in November 2001. Silver rose by 14% from $4.36 per ounce to $4.98 per ounce in the same period12

2007-2009 Recession: This recession was caused by the subprime mortgage crisis, the global financial crisis, and the Great Recession. Gold rose by 26% from $833 per ounce in December 2007 to $1,050 per ounce in June 2009. Silver rose by 22% from $14.76 per ounce to $18 per ounce in the same period12

2020 Recession: This recession was caused by the COVID-19 pandemic, which led to lockdowns, shutdowns, and stimulus measures around the world. Gold rose by 25% from $1,517 per ounce in December 2019 to $1,895 per ounce in December 2020. Silver rose by 47% from $17.85 per ounce to $26.35 per ounce in the same period12

As we can see from these examples, gold and silver tend to perform well during recessions that are accompanied by high inflation, low interest rates, weak dollar, geopolitical tensions, and uncertainty. However, they tend to perform poorly during recessions that are accompanied by low inflation, high interest rates, a strong dollar, monetary tightening, and stability. Moreover, silver tends to be more sensitive and responsive to changes in the economic and market conditions than gold, which makes it more risky but also more rewarding.

Factors That Influence Gold and Silver Prices and Demand During a Recession or a Depression

Many factors can affect the prices and demand of gold and silver during a recession or a depression. Some of the most important ones are:

Investor Sentiment: Investor sentiment is the overall attitude and confidence of investors towards the economy and the markets. When investor sentiment is positive, investors tend to favour riskier assets such as stocks and bonds, which reduces the demand for safe-haven assets such as gold and silver. When investor sentiment is negative, investors tend to favour safer assets such as gold and silver, which increases the demand for them.

Inflation and Deflation: Inflation is the general increase in the prices of goods and services over time, while deflation is the general decrease in the prices of goods and services over time. Inflation erodes the purchasing power of money and reduces the real returns of fixed-income assets such as bonds, which boosts the demand for inflation-hedge assets such as gold and silver. Deflation increases the purchasing power of money and enhances the real returns of fixed-income assets such as bonds, which reduces the demand for deflation-hedge assets such as gold and silver.

Interest Rates: Interest rates are the cost of borrowing or lending money. They are determined by the supply and demand of money in the economy, as well as by the monetary policy of the central bank. Interest rates affect the opportunity cost of holding gold and silver, which do not pay any interest or dividends. When interest rates are high, investors tend to sell their gold and silver holdings to invest in higher-yielding assets such as bonds or bank deposits. When interest rates are low, investors tend to buy more gold and silver holdings to avoid losing money on low-yielding assets such as bonds or bank deposits.

Currency Movements: Currency movements are the changes in the exchange rates between different currencies. They are influenced by various factors such as trade balances, capital flows, inflation rates, interest rates, political events, and market expectations. Currency movements affect the relative value of gold and silver, which are priced in U.S. dollars in the international market. When the U.S. dollar appreciates against other currencies, it makes gold and silver more expensive for foreign buyers, which lowers their demand. When the U.S. dollar depreciates against other currencies, it makes gold and silver cheaper for foreign buyers, which increases their demand.

Industrial Demand: Industrial demand is the amount of gold and silver that is used for various industrial applications such as electronics, solar panels, medical devices, photography, etc. Industrial demand is influenced by factors such as economic growth, technological innovation, consumer preferences, environmental regulations, etc. Industrial demand affects the supply and demand balance of gold and silver in the market. When industrial demand is high, it reduces the available supply of gold and silver in the market, which pushes their prices up. When industrial demand is low, it increases

Tips for Investing in Gold and Silver During a Recession or a Depression

Investing in gold and silver during a recession or a depression can be a smart and profitable strategy, but it also requires some careful planning and research. Here are some tips for investors who want to take advantage of the potential benefits of gold and silver during a recession or a depression:

Diversify Your Portfolio: Diversifying your portfolio means allocating your assets among different types of investments that have different risk and return characteristics. This can help you reduce your overall risk and enhance your overall return. Gold and silver can be an effective diversification tool for your portfolio, as they tend to have a low or negative correlation with other assets such as stocks and bonds. This means that they tend to move in opposite or different directions from other assets, which can help you balance your portfolio and protect it from market fluctuations.

Choose Your Investment Vehicle: Choosing your investment vehicle means deciding how you want to invest in gold and silver. There are different ways to invest in gold and silver, such as physical bullion, coins, bars, jewellery, exchange-traded funds (ETFs), futures contracts, options contracts, mining stocks, etc. Each of these investment vehicles has its advantages and disadvantages, such as liquidity, convenience, security, cost, taxation, etc. You should choose the investment vehicle that suits your investment objectives, risk tolerance, time horizon, budget, etc.

Do Your Homework: Doing your homework means researching the market conditions and trends that affect the prices and demand of gold and silver. You should keep yourself updated on the economic indicators, monetary policies, currency movements, inflation rates, interest rates, industrial demand, investor sentiment, etc. that influence the performance of gold and silver. You should also compare the historical and current prices and ratios of gold and silver to identify the best entry and exit points for your investments. You should also consult reputable sources of information and analysis such as websites, newsletters, blogs, podcasts, etc. that specialise in gold and silver investing.

Buy Low and Sell High: Buying low and selling high means timing your purchases and sales of gold and silver to maximise your profits. You should buy gold and silver when their prices are low or undervalued relative to their fundamentals or potential. You should sell gold and silver when their prices are high or overvalued relative to their fundamentals or potential. You should avoid buying gold and silver when their prices are rising rapidly or reaching record highs, as this may indicate a bubble or a peak that may soon burst or reverse. You should also avoid selling gold and silver when their prices are falling rapidly or reaching record lows, as this may indicate a panic or a bottom that may soon bounce back or recover.

Conclusion

Gold and silver are two precious metals that have proven to be safe-haven assets during times of crisis such as recessions or depressions. They can help investors preserve their wealth and hedge against inflation, currency devaluation, and market volatility. However, investing in gold and silver during a recession or a depression also requires some knowledge and skills to navigate the complex and dynamic market conditions and trends that affect their prices and demand.

Disclaimer: This article is intended as an opinion piece and does not constitute financial advice. Investing in bullion carries risks, and individuals should conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Links for places to start investing now:

- https://bullionnow.com.au

- https://www.ainsliebullion.com.au

- https://www.abcbullion.com.au

- https://guardian-gold.com.au

Try our bullion tracker today and see the benefits for yourself!

Our bullion tracker is the easiest way to track the value of your precious metals holdings. It's fast, easy to use, and affordable.

Here are just a few of the benefits of using our bullion tracker:

- Stay organised: Keep track of all of your precious metals holdings in one place.

- Make informed decisions: Know the current value of your holdings so you can make better decisions about when to buy and sell.

- Save money: Avoid overpaying for precious metals by knowing the current market value.

Plus, we offer a free 30-day trial so you can try our bullion tracker risk-free.

Sign up today and start tracking the value of your precious metals holdings!

Start your free trial now: https://goldsilverstacker.com